As thousands of new commercial drone operators enter the market, drone insurance becomes a big issue for many. But what’s the right type of insurance for your business? Here’s our analysis of the costs and benefits of on-demand drone insurance, like Verifly, vs. an annual policy from your broker.

As thousands of new commercial drone operators enter the market, drone insurance becomes a big issue for many. But what’s the right type of insurance for your business? Here’s our analysis of the costs and benefits of on-demand drone insurance, like Verifly, vs. an annual policy from your broker.

What are the Benefits to On-demand Insurance?

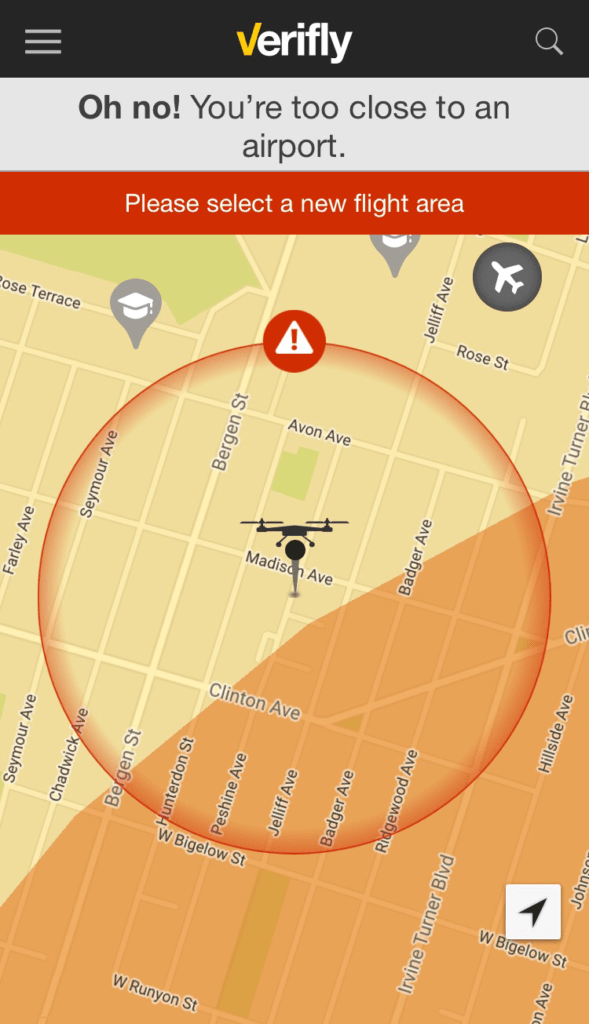

There are three major advantages to on-demand insurance like Verifly: it’s easy, it’s fast, and it’s cheap. And it can help to keep you out of trouble – for example, Verifly won’t insure you if you’re trying to fly in a restricted area. With an app-based product, you can immediately obtain proof of insurance, allowing you to meet on-the-fly (pun intended) demands. Depending upon your business application and how many times a year you fly, on-demand insurance may be just what you’re looking for – but it may not always be the best, or even the most inexpensive, option.

Cost counts

“Verifly wasn’t designed to cover everyone,” says UAV insurance specialist Evan Garmon of Harpenau Insurance in Indiana. “It really works best for the hobby or small commercial operator who is flying a few times a year – like a real estate agent going up only for a few choice properties.” Garmon says the math is clear. Verifly currently prices a basic, low-risk application – that’s flying in an open area not around any restricted airspace – at $10/hour; that provides a single drone with $1 million in liability coverage. An annual policy offering similar coverage runs pretty consistently between $800 – $875 per year; so a business flying more than 80 hours a year – that’s less than a couple of hours a week – would save money on an annual policy. Professional operators with 200-1000 hours of expert flying experience may qualify for discounts.

If you aren’t flying in low-risk areas, the cost benefit of on-demand insurance goes down further; the price per hour rises depending upon your location.

What’s Covered?

On-demand insurance “puts a lot more control in the hands of the operator,” says Garmon. “That can be both good and bad.” While on-demand insurance offers operators fast proof of coverage for an occasional need, coverage is limited – and new commercial drone operators may not realize that they need a bigger policy. Verifly only covers liability on your drone if you hit someone or damage their property; it doesn’t cover personal liability if someone should accuse the operator of illegal behavior, or physical damage to the drone itself. For small operators using an inexpensive drone, that may not be a concern: but for a commercial operation using industrial aircraft it’s significant. “When a drone costs over $3,000, it starts to make a difference,” says Garmon, who estimates that coverage on a $3,000 drone would generally run about $450 annually. Unfortunately, you can’t generally get one type of insurance without the other – using an on-demand insurance for liability and getting a smaller policy just for physical damage to the drone -insurance companies will require that you carry both.

Additionally, on-demand insurance may not cover the other business requirements in your state. Some states require that businesses carry worker’s comp insurance, for example, or insurance on a business vehicle. If you aren’t sure, it may be time to get an agent: “I don’t mean to be prejudiced,” laughs Garmon. “But the benefit of having an agent is the expertise – they can customize for your business. If you’re growing a business, you might have other needs.”

How Much Do You Need?

Verifly’s current standard liability coverage is $1 million – but you can’t double up to up the total. The company has a strict “no stacking” policy, which means that you can’t use their policy on top of another to increase your coverage, or try to use two of their policies to double your coverage. If you need more than the currently offered amount, you’ll have to go to another broker.

Location, location, location.

Verifly works by providing coverage within a restricted area and a restricted timeframe – “precision insurance.” The coverage area is currently a .5 mile radius from the location that you specify; future updates may increase the zone. But if you’re outside of the area, you aren’t covered – and that means that a fly-away could take you outside of your insurance zone. And while a new update may allow users with a waiver to fly in restricted airspace, currently that’s not an option.

Finally, Verifly is not offered in every state – if you’re considering using it for an upcoming job, be sure to check availability first.

For new commercial drone businesses, getting a Part 107 license is just the first step – building a new business involves many more. Businesses should research insurance options and requirements in their state: “Licensed and insured” is a tagline all operators should offer.

Unmanned Aerial Vehicle The latest drone news

Unmanned Aerial Vehicle The latest drone news