Guest post by Kay Wackwitz, Drone Industry Insights —

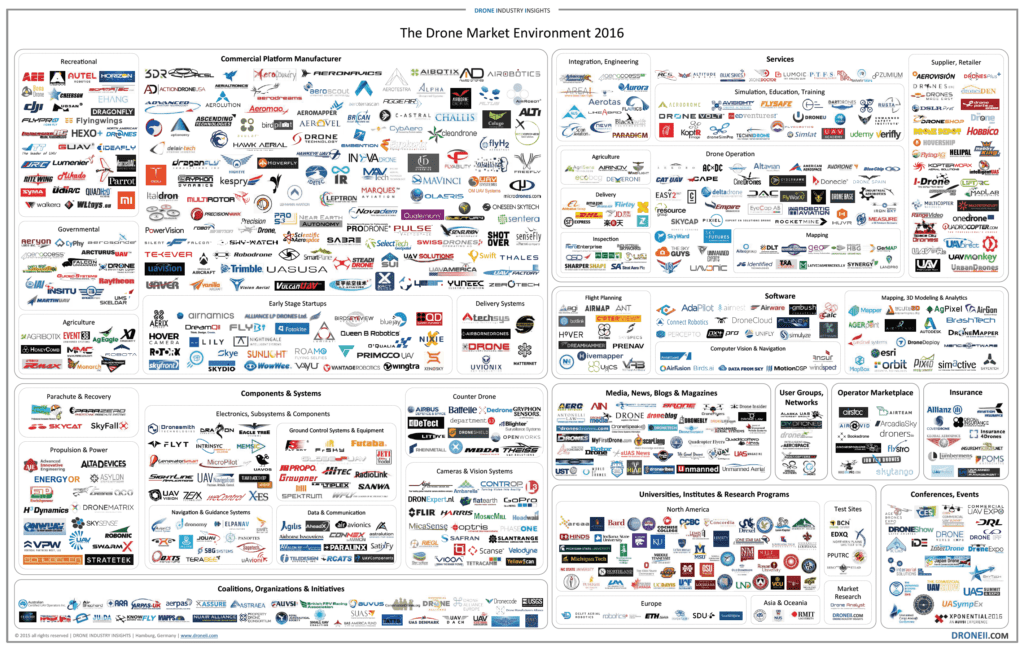

Last year we published the initial Drone Market Environment Map and it was so successful that we updated and enlarged it to visualize the current evolutionary stage. This map provides the most comprehensive picture of the global drone ecosystem, making the drone market more transparent and accessible for prospective customer, investors and newbies.

Diversity dominates

The maps philosophy is to present the strong diversity of the market instead of only focusing on a specific UAV sector/category. Hence, the user benefits from a horizontal view and insight into the UAV market as a whole. For example, there are tens of thousands of registered operators around the world, but for clarity’s sake we only picked those with special concepts or those already operating on a certain industrial scale.

Click on image to download PDF

On the drone market map you’ll find 711 entries from 49 Countries led by UAV companies from North America (54%) and followed by Europe (30%), Asia (9%), Oceania (3%), MEA (3%) and South America (1%).

It is clustered in the following UAV market categories: Platforms (29%), Components and Systems (16%), Services (20%), Universities and Research Programs (10%), Software (7%), News/Media/Blogs (6%), Coalition/Organizations/Initiatives (5%), Conferences and Events (3%), Operator Marketplaces (2%), Drone Insurances (2%), User Groups/Networks (1%)

Many companies on the market map are at a mature growth stage – others are in an early startup or concept stage, containing revolutionary approaches or technologies. The majority, however, are SMEs with an average age of 6,5 years and an average of 8,3 employees.

What has changed within the last year on the UAV market?

Compared to the first map you will recognize a stronger differentiation. There are more sub categories revealing that many UAV companies identified and started occupying market niches. Many business models changed or got much more specific over the last year creating powerful concepts and future-proof verticals.

3DR for example completely gave up the recreational sector and is focusing on commercial solutions only. Insitu expanded their portfolio and started manufacturing platforms not just for military, but also for civil and commercial applications.

DJI, the market leader in the recreational sector, now expands into the commercial market with platforms for professional media production and agricultural crop dusting solutions.

This sort of differentiation can also be observed in software, services, components and systems.

What to expect of the UAV market?

We expect the market to further grow and with it, the variety of end-to-end business models. There are plenty of niches waiting to be discovered and occupied. Hardware will become more capable allowing new applications. Advanced drone operation regulations will allow new use cases with a high grade of automation. The drone ecosystem is strongly technology driven and market growth will additionally be catalyzed by developments outside the drone market environment (e.g. mobile phone industry, etc.).

For your convenience and to learn more about the companies shown on the map, we offer a Database with name, cluster, sub cluster, country, address, city, state, ZIP, ULR, e-mail and phone number for of each of the 711 items.

In case you have missed one of our last articles:

Source link

Unmanned Aerial Vehicle The latest drone news

Unmanned Aerial Vehicle The latest drone news