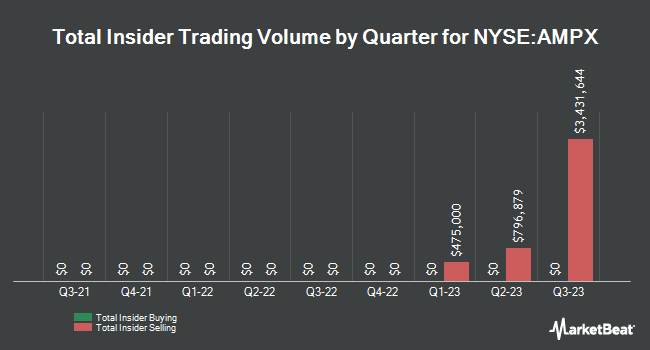

Amprius Technologies, Inc. (NYSE:AMPX – Get Free Report) major shareholder Amprius, Inc. sold 100,000 shares of the firm’s stock in a transaction dated Friday, December 15th. The shares were sold at an average price of $3.54, for a total transaction of $354,000.00. Following the completion of the sale, the insider now owns 65,215,552 shares of the company’s stock, valued at $230,863,054.08. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Large shareholders that own 10% or more of a company’s stock are required to disclose their transactions with the SEC.

Amprius, Inc. also recently made the following trade(s):

- On Wednesday, December 13th, Amprius, Inc. sold 100,000 shares of Amprius Technologies stock. The stock was sold at an average price of $3.62, for a total value of $362,000.00.

Amprius Technologies Stock Down 1.7 %

Shares of NYSE:AMPX traded down $0.06 during trading on Friday, reaching $3.48. 602,327 shares of the company traded hands, compared to its average volume of 303,029. The firm has a market capitalization of $307.62 million, a PE ratio of -8.92 and a beta of 2.94. Amprius Technologies, Inc. has a 52 week low of $2.60 and a 52 week high of $10.63. The company’s 50 day moving average is $3.59 and its two-hundred day moving average is $5.47.

Amprius Technologies (NYSE:AMPX – Get Free Report) last announced its quarterly earnings data on Thursday, November 9th. The company reported ($0.10) earnings per share (EPS) for the quarter, topping analysts’ consensus estimates of ($0.13) by $0.03. The firm had revenue of $2.80 million for the quarter, compared to the consensus estimate of $0.66 million. Amprius Technologies had a negative net margin of 560.89% and a negative return on equity of 48.58%. As a group, research analysts anticipate that Amprius Technologies, Inc. will post -0.44 EPS for the current year.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in AMPX. Invesco Ltd. acquired a new position in Amprius Technologies during the third quarter worth about $8,006,000. BlackRock Inc. lifted its stake in Amprius Technologies by 144.3% in the 2nd quarter. BlackRock Inc. now owns 408,720 shares of the company’s stock valued at $2,935,000 after purchasing an additional 241,384 shares during the last quarter. Geode Capital Management LLC boosted its position in Amprius Technologies by 46.2% in the second quarter. Geode Capital Management LLC now owns 163,138 shares of the company’s stock valued at $1,171,000 after buying an additional 51,524 shares in the last quarter. Kestra Advisory Services LLC bought a new stake in shares of Amprius Technologies during the third quarter worth $484,000. Finally, Charles Schwab Investment Management Inc. increased its holdings in shares of Amprius Technologies by 21.6% during the third quarter. Charles Schwab Investment Management Inc. now owns 95,424 shares of the company’s stock worth $452,000 after buying an additional 16,922 shares in the last quarter. 2.60% of the stock is currently owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research analysts have commented on AMPX shares. Alliance Global Partners assumed coverage on Amprius Technologies in a report on Tuesday, December 5th. They issued a “buy” rating and a $10.00 price objective on the stock. HC Wainwright began coverage on shares of Amprius Technologies in a research report on Tuesday, October 31st. They set a “buy” rating and a $10.00 price target on the stock. Five investment analysts have rated the stock with a buy rating, According to MarketBeat.com, the company presently has an average rating of “Buy” and a consensus price target of $11.75.

Read Our Latest Stock Report on AMPX

About Amprius Technologies

(Get Free Report)

Amprius Technologies, Inc produces and sells ultra-high energy density lithium-ion batteries for mobility applications. The company offers silicon nanowire anode batteries. Its batteries are primarily used for existing and emerging aviation applications, including unmanned aerial systems, such as drones and high-altitude pseudo satellites.

Read More

Receive News & Ratings for Amprius Technologies Daily – Enter your email address below to receive a concise daily summary of the latest news and analysts’ ratings for Amprius Technologies and related companies with MarketBeat.com’s FREE daily email newsletter.

Unmanned Aerial Vehicle The latest drone news

Unmanned Aerial Vehicle The latest drone news