SUMMARY

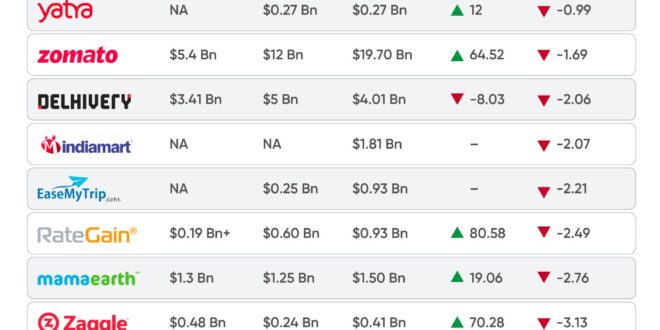

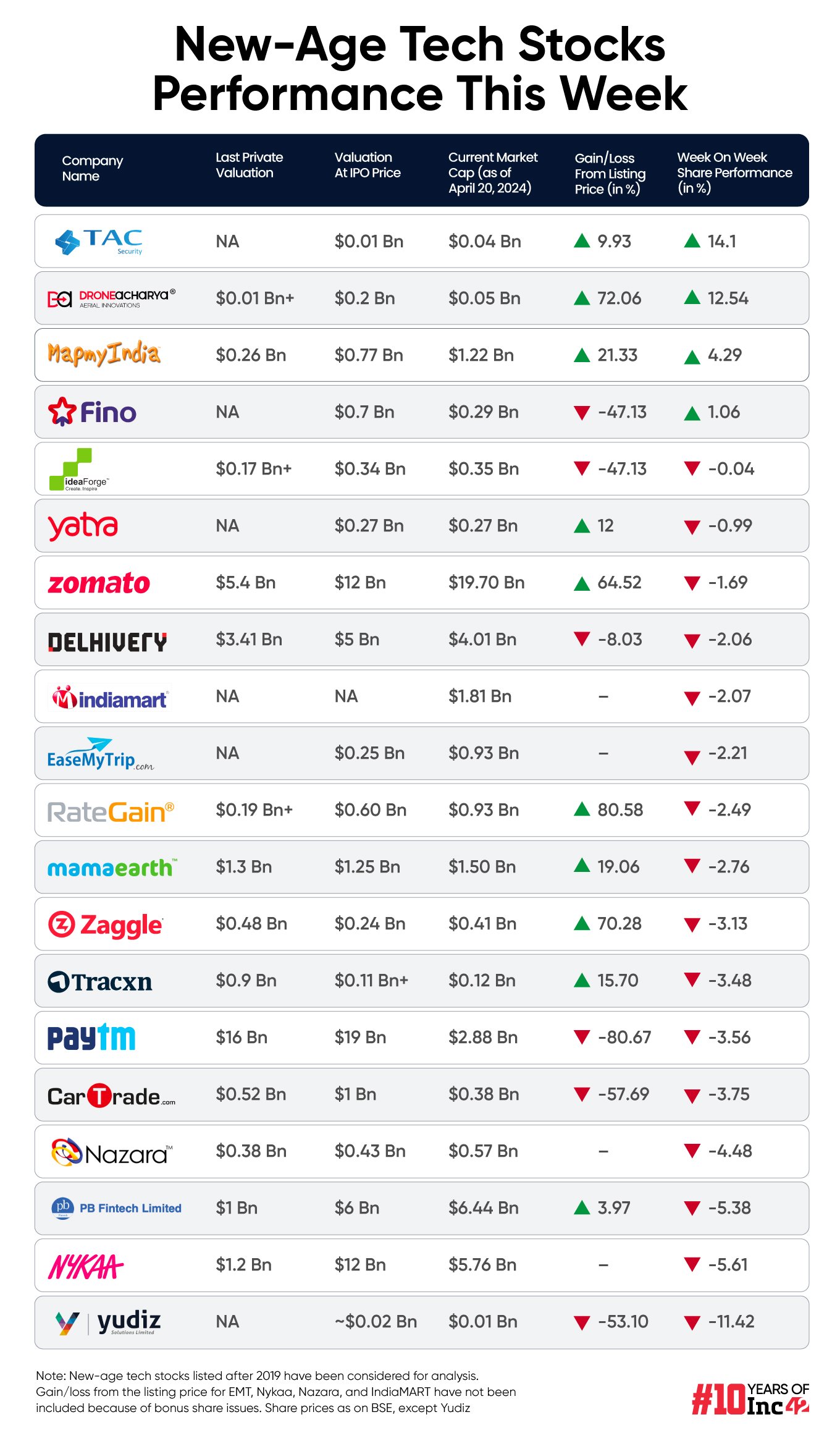

Sixteen out of the 20 new-age tech stocks under Inc42’s coverage fell this week in a range of 0.04% to over 11% on the BSE, with Yudiz turning out to be the biggest loser

The newest addition in the new-age tech stocks, NSE Emerge-listed TAC Infosec emerged as the biggest gainer this week as its shares rallied over 14%

In the broader market, benchmark indices Sensex fell 1.56% to 73,088.33 and Nifty50 declined 1.65% to 22,147 amid rising tensions in the Middle East

Indian new-age tech stocks came under selling pressure this week on the back of a slump in the broader equity market, largely hurt by the fresh unrest in the Middle East.

Sixteen out of the 20 new-age tech stocks under Inc42’s coverage fell this week in a range of 0.04% to over 11% on the BSE, with Yudiz emerging as the biggest loser.

PB Fintech and Nykaa slumped over 5% each, Nazara fell 4.5%, while Zaggle, Tracxn, Paytm, and CarTrade were down over 3% each this week.

Meanwhile, the newest addition in the new-age tech stocks, NSE Emerge-listed TAC Infosec emerged as the top gainer this week as its shares rallied over 14%.

On the other hand, shares of DroneAcharya gained 12.5% this week. MapmyIndia and Fino Payments Bank were the two other gainers, with their shares zooming 4.3% and 1.1%, respectively.

In the broader market, benchmark indices Sensex fell 1.56% to 73,088.33 and Nifty50 declined 1.65% to 22,147. Besides the escalation in tensions between Iran and Israel, a largely muted Q4 FY24 performance of IT companies led to a slump in the market.

Though the domestic equity market ended the week in the green, with some upward momentum on Friday (April 19), uncertainty remains, largely due to the fresh conflict in the Middle East having a negative impact on oil prices.

Speaking on the market performance this week, Vinod Nair, head of research at Geojit Financial Services, said, “Globally, caution persisted as the situation in the Middle East remains fragile. Further, the potential delay of a US rate cut due to higher-than-expected inflation, robust retail sales, and elevated oil prices invoked subdued sentiments.”

“Muted Q4 earnings expectations and weak IT results could extend the consolidation. FIIs continued to remain risk-averse, a trend seen since last week,” said Nair, adding that large caps could offer solace for investors with their earnings stability.

This week, the market remained closed on Wednesday (April 17) on the occasion of Ram Navmi.

In the coming week, the market will react to global cues and the Q4 performance of the index heavyweights such as Wipro, HUL, Maruti, and Bajaj Finance, as well as certain economic data points, said Siddhartha Khemka, head of retail research at Motilal Oswal.

Now, let’s take a look at the performance of some of the new-age tech stocks this week.

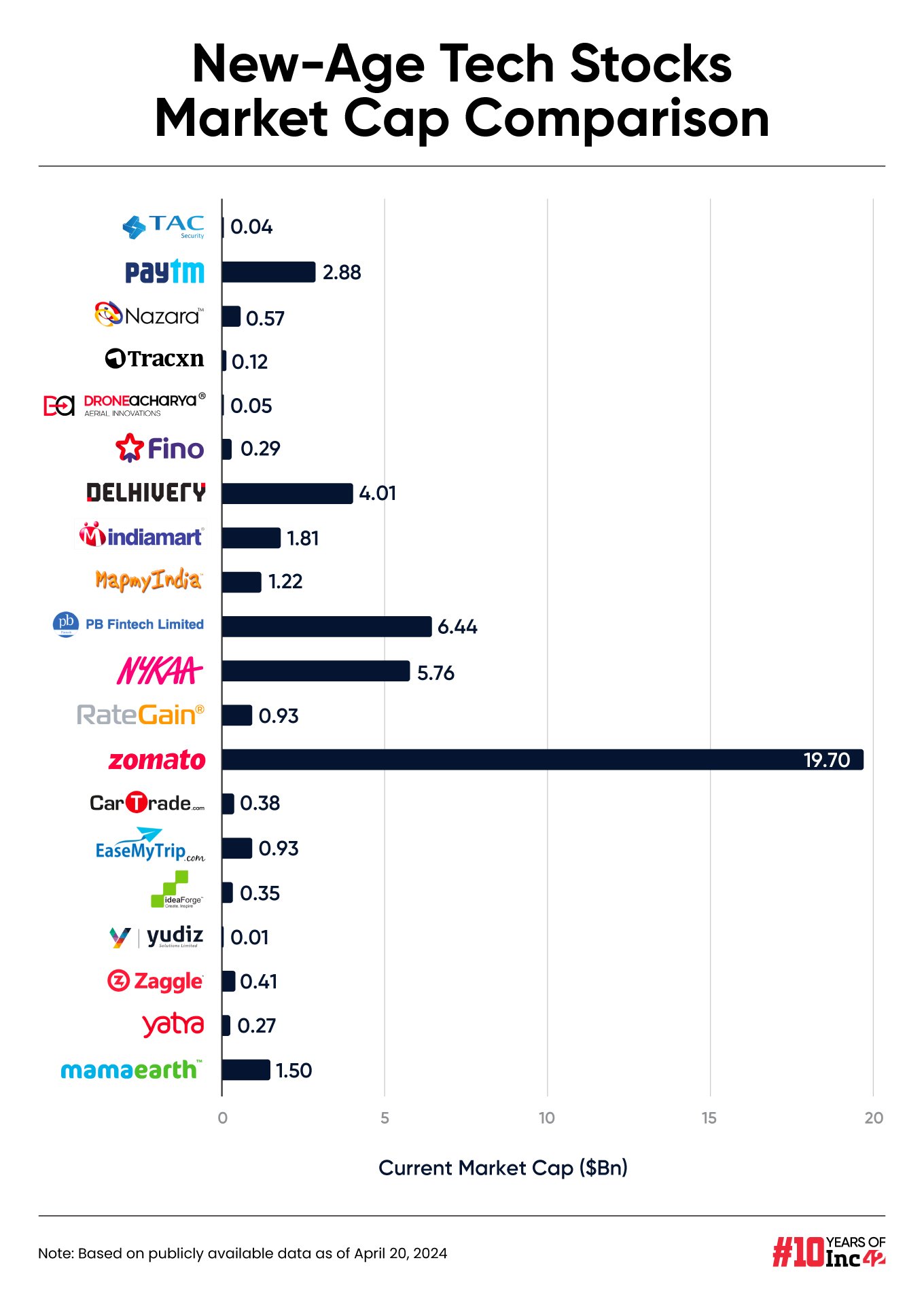

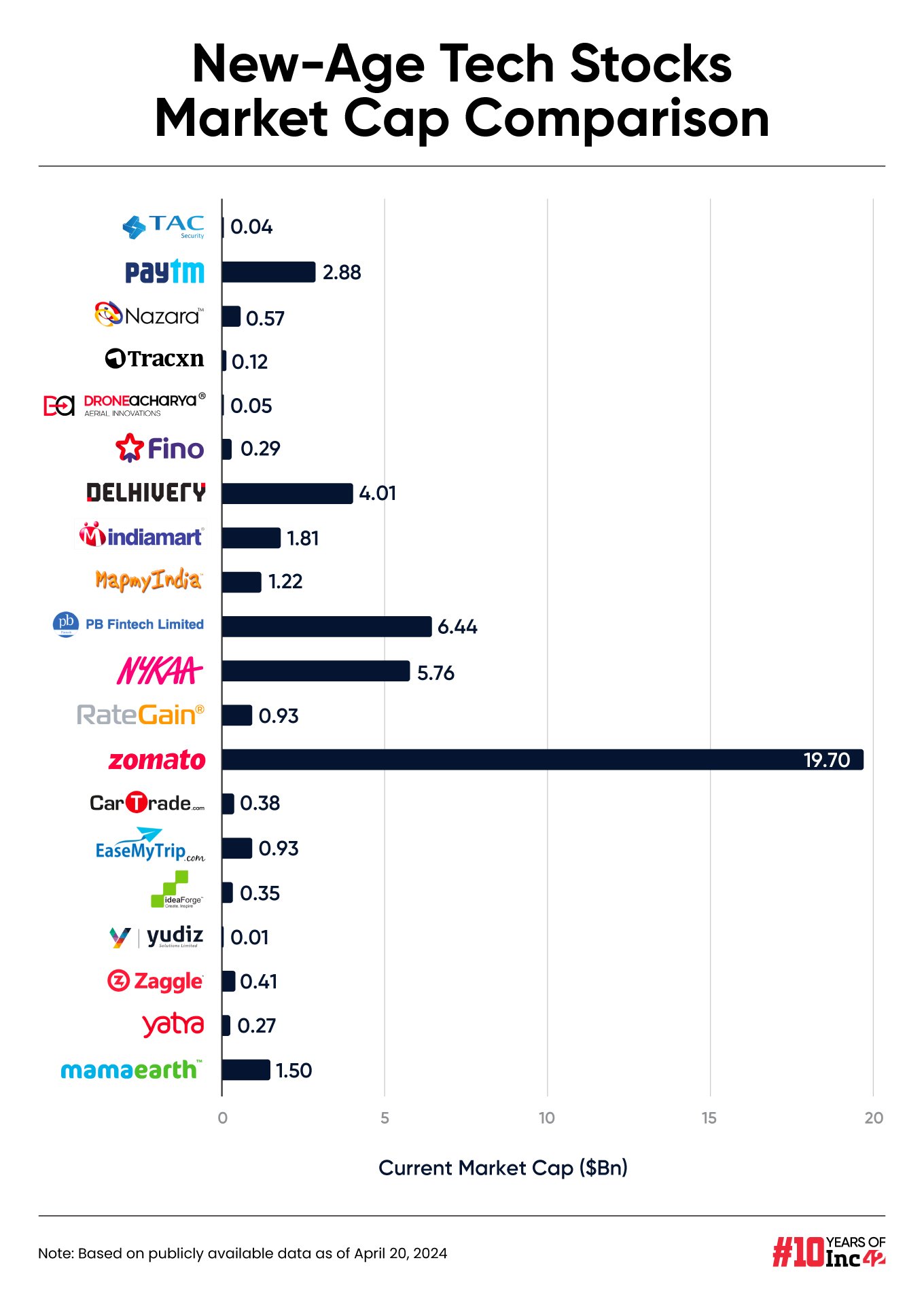

The total market capitalisation of the 20 new-age tech stocks now under Inc42’s coverage stood at $47.67 Bn at the end of this week.

Paytm’s Mixed Week

Shares of Paytm were largely under selling pressure this week and slumped 3.6% overall, ending Friday’s trading session at INR 377.9 on the BSE.

Adding to the fintech major’s existing woes, the Centre has now reportedly deferred the approval of its INR 50 Cr investment in its arm Paytm Payment Services.

A report earlier this week stated that the government’s step was partly due to concerns about China-based Antfin (Netherlands) Holdings’ shareholding in its parent entity One 97 Communications.

However, Paytm said that the report was “misleading” and it did not receive any such communication from the government.

On the other hand, in a respite after the crisis in Paytm Payments Bank, Paytm began migrating its UPI users to new payment system provider (PSP) banks’ handles after getting a nod from the National Payment Corporation of India (NPCI).

Paytm has expedited the integration with Axis Bank, HDFC Bank, State Bank of India (SBI), and Yes Bank to continue its UPI operations through these PSP banks.

It is pertinent to note that the shares of Paytm have nosedived over 50% since the beginning of the payments bank crisis on January 31 this year.

Commenting on Paytm’s share performance, Rupak De, senior technical analyst at LKP Securities, said that weakness might continue in the stock until it moves back above INR 410. On the lower end, Paytm shares might fall towards INR 330, De said.

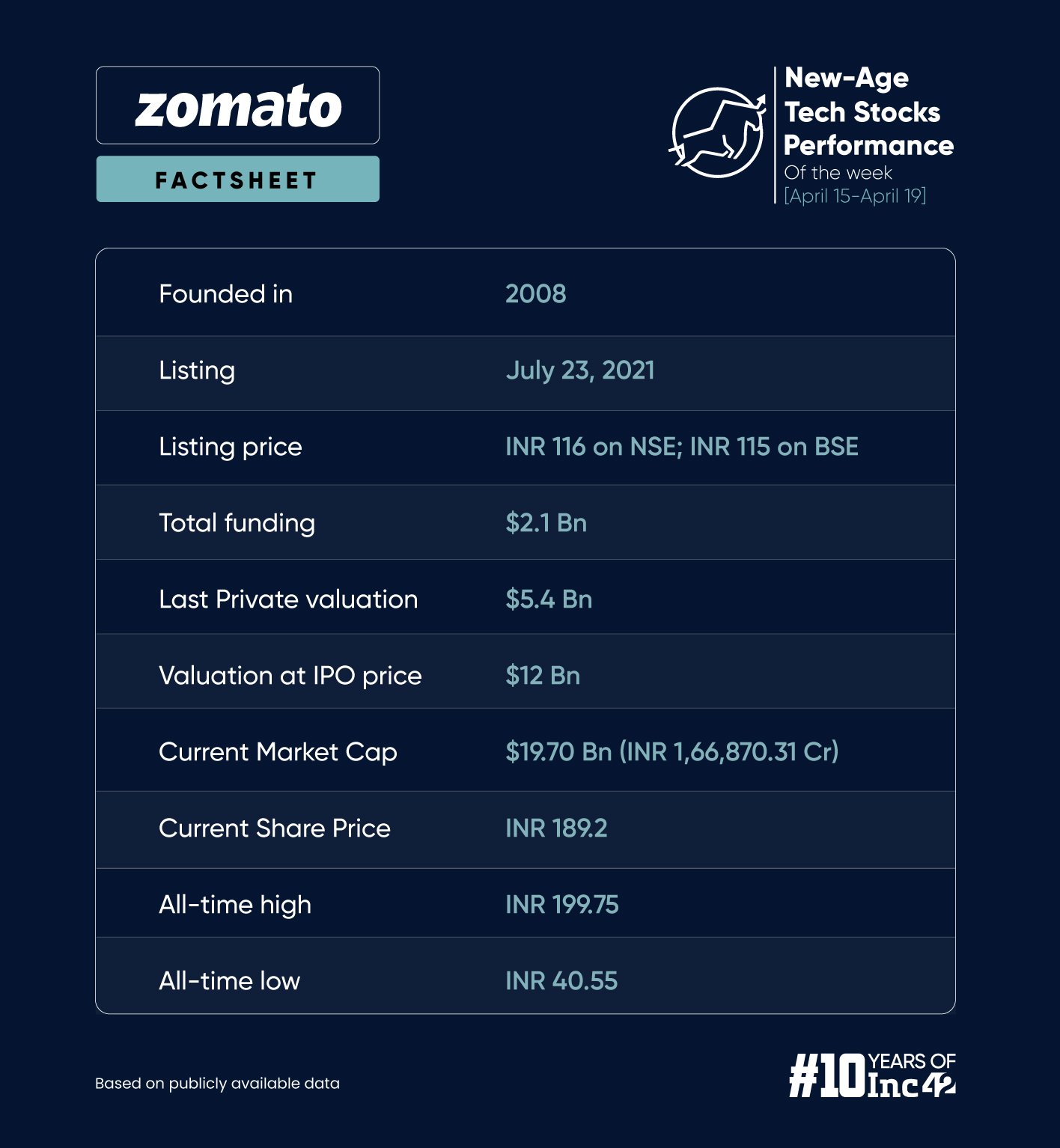

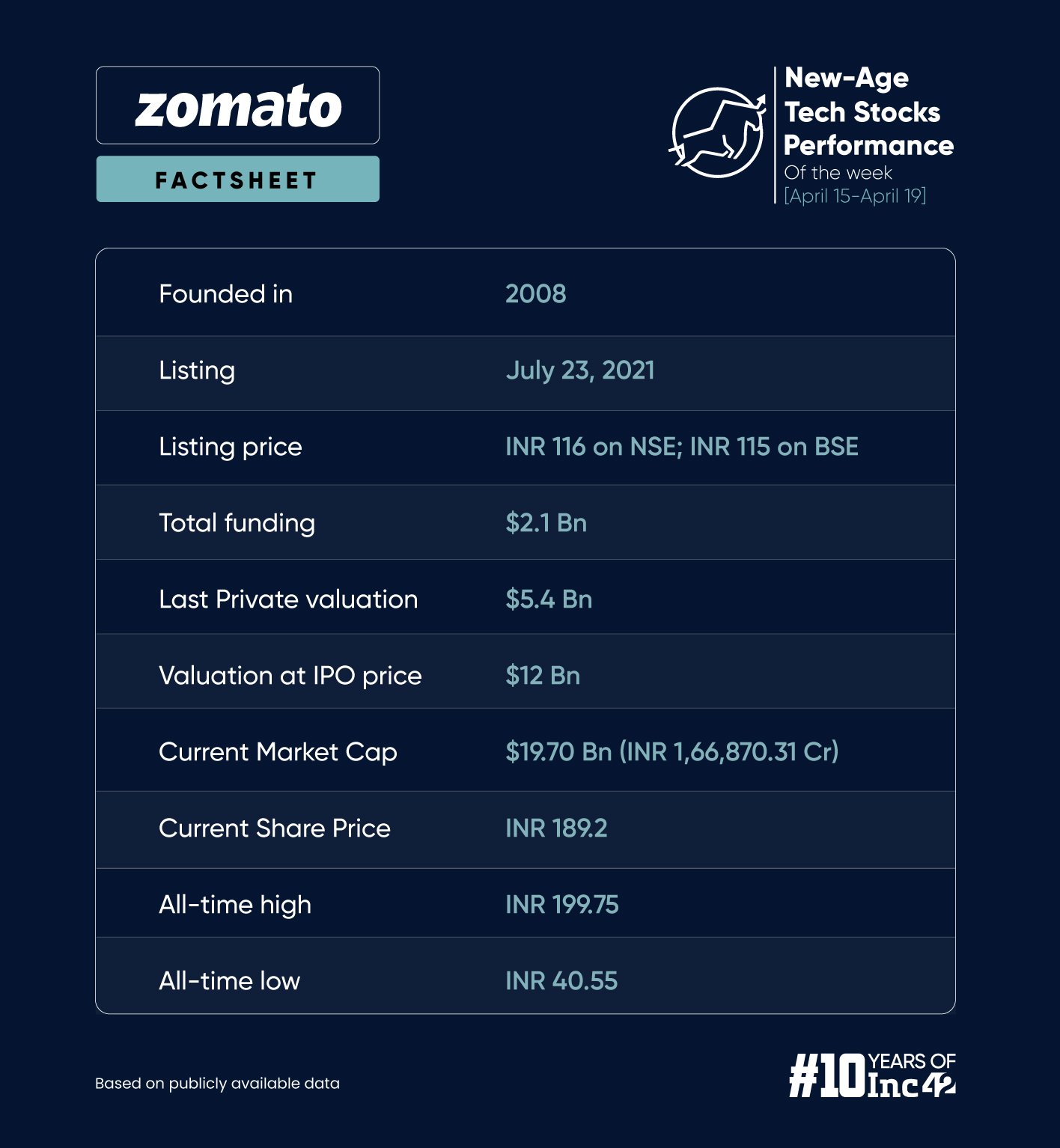

No End To Zomato’s Tax Troubles

Foodtech major Zomato on Friday said that it received a goods and services tax (GST) notice of INR 11.8 Cr from the Gurugram GST authority.

As per its exchange filing, the new tax order consists of INR 5.9 Cr GST demand and a penalty of INR 5.9 Cr.

Zomato has been grappling with tax issues for some time and has received multiple such notices in the recent past. However, its shares have largely remained unaffected due to its strong financial performance over the last few quarters and D-Street’s bullish estimates on Blinkit’s growth.

In a research report this week, Bernstein said that India’s online food delivery market is moving in favour of Zomato, driven by its stronger execution and wider reach.

Meanwhile, Blinkit and Swiggy’s Instamart are the top two players in the quick commerce space. While Blinkit’s gross merchandise value (GMV) stood at $510 Mn in H1 2023, Instamart’s GMV was at $419 Mn, noted the brokerage, adding that Blinkit also leads on profitability.

With the improving market share in its food delivery and quick commerce business, Zomato also continued with its experiments. Earlier this week, the company unveiled an all-electric large order fleet to deliver orders for up to 50 people in one go.

Amid the volatility in the broader market, shares of Zomato fell 1.7% this week, ending Friday’s trading session at INR 189.2 on the BSE. The shares are trading almost 53% higher year to date.

LKP’s De expects Zomato to continue its upward momentum and move towards INR 200 mark in the short term. The support for the stock is at INR 180, he added.

DroneAcharya Continues To Fly High

In a new development this week, the drone startup said that it inked an agreement with CBAI Technologies Private Limited to procure 200 Type Certified training drones over a span of three years.

The agreement marks a significant stride in DroneAcharya’s mission to revolutionise drone education and skill development in the country, the startup said in an exchange filing.

Earlier this week, DroneAcharya also announced opening its fourth drone training centre in Jaipur, Rajasthan, in partnership with Subhkhyati Aerospace Pvt. Ltd.

Amid these announcements, shares of DroneAcharya gained sharply in three consecutive trading sessions. Overall, the stock emerged as the second biggest gainer this week with a 12.5% rally, ending the week’s trading at INR 175.5 on the BSE.

LKP’s De said that DroneAcharya shares look positive on the technical chart and have support at INR 168. If the support level is not broken, it might move past the INR 200 mark, he added.

Unmanned Aerial Vehicle The latest drone news

Unmanned Aerial Vehicle The latest drone news