Business Insider has launched their newest drone market forecast, and it signifies that trade development continues to be strong.

While the report says that business development was considerably boosted by the enactment of Part 107 and the regularization of economic drone use, Business Insider says that forecasting the drone trade is difficult. While Gartner analysis says that whole drone unit gross sales climed to 2.2 million in 2016, the Consumer Technology Association says that 2.four million private drones had been offered simply within the U.S. throughout 2016, doubling the quantity offered in 2015.

The discrepency comes, explains BI, as a result of Gartner defines drones as plane that connect with the Internet, whereas CTA counts smaller toy drones that will not even have to course of knowledge.

Using BI’s personal definition, nonetheless, drone gross sales are charging ahead. “BI Intelligence, Business Insider’s premium research service, defines drones as aerial vehicles that can fly autonomously or be piloted by a remote individual,” says BI. “Under that criterion, BI Intelligence expects sales of drones to surpass $12 billion in 2021. That’s up by a compound annual growth rate (CAGR) of 7.6% from $8.5 billion in 2016.”

The firm predicts development throughout all the three main segments of the trade: client, business, and authorities.

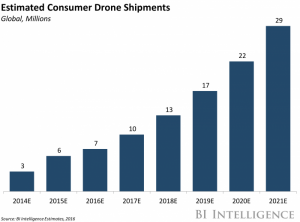

“Consumer drones are drones purchased by individuals for noncommercial and nonprofessional purposes. BI Intelligence expects consumer drone shipments to hit 29 million in 2021, which would indicate a CAGR of 31.3%,” says the report. “For enterprise drones, BI Intelligence expects shipments to reach 805,000 in 2021 with a five-year CAGR of 51% from 102,600 in 2016.”

“Finally, government drones fall into two categories: military and public safety. The forecast for these is a less clear, but the military drone market is by far the most mature right now. The U.S. military has been using drones for combat since 2001, and it rapidly expanded its drone fleet to more than 7,000 by 2012. The Department of Defense budget in 2016 allocated $2.9 billion for more than 50 new drones for combat and surveillance, according to the Bard Center for the Study of Drones.”

Researchers additionally predict that market big DJI could face competitors within the coming years. “In 2015, consultancy Frost & Sullivan estimated that China-based DJI owned 70% of the market for consumer and commercial drones. Its Phantom drones are the most popular in the world for both consumer and commercial purposes thanks to their reliability and superior photography and video capture capabilities,” says BI.

“But several smaller companies, such as 3D Robotics, Lilu, Yuneec, and Parrot are all trying to chip away at DJI’s market share.”

The report concludes that the business market would be the phase that drives the trade. “The enterprise drone market has significantly greater long-term potential both in size and economic impact than the consumer or military drone industries. It is the smallest but fastest-growing drone market by revenue,” says BI.

Unmanned Aerial Vehicle The latest drone news

Unmanned Aerial Vehicle The latest drone news